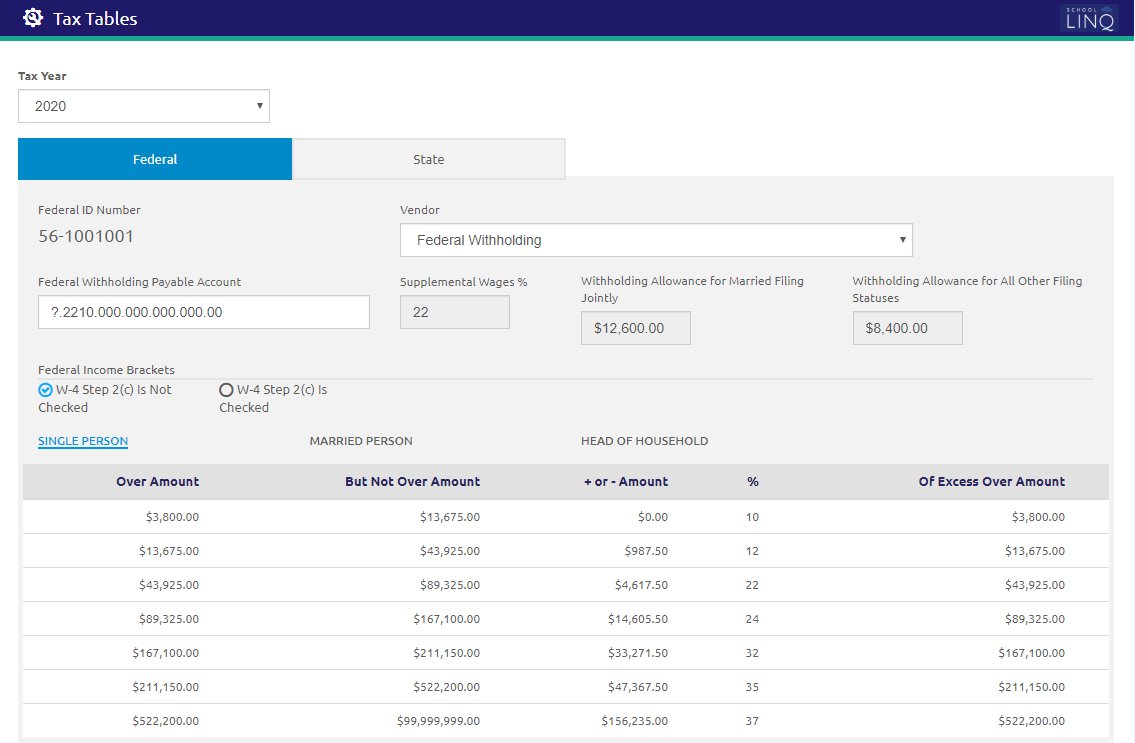

Tax Tables

Tax Tables allows users to set up the Federal and State Withholding tables and displays the federal EIC table. This is where all of the Federal and State (Alabama, Michigan or North Carolina) withholding vendors' information is kept. When payroll is finalized and run, an invoice will be created with the withholding amount for all employees. From there, the user will need to open the invoice in Fund Management to pay the State the required withholding amount from the employees' paychecks.

For current tax withholding tables, please refer to the documentation provided by the IRS and your state’s Department of Revenue. School LINQ uses the Annualized Tax Tables for each.

Federal Tab

-

Select a year from the Tax Year drop-down list.

- The Federal ID Number field is read-only and displays the given values from Unit Setup.

- Select the vendor from the Vendor drop-down list.

- When payroll is finalized, invoices will be generated to this vendor for all federal taxes withheld.

- Vendors are managed in Fund Management.

- Enter the account code template to be used for federal withholding in the Federal Withholding Payable Account field.

- Payroll processing will use the job’s account digits in place of the question marks on the template.

- The Supplemental Wages % and Withholding Allowance fields are automatically populated by School LINQ each year according to the published Federal tax tables.

- NOTE: The fields displayed are determined by the Federal Income Brackets selections.

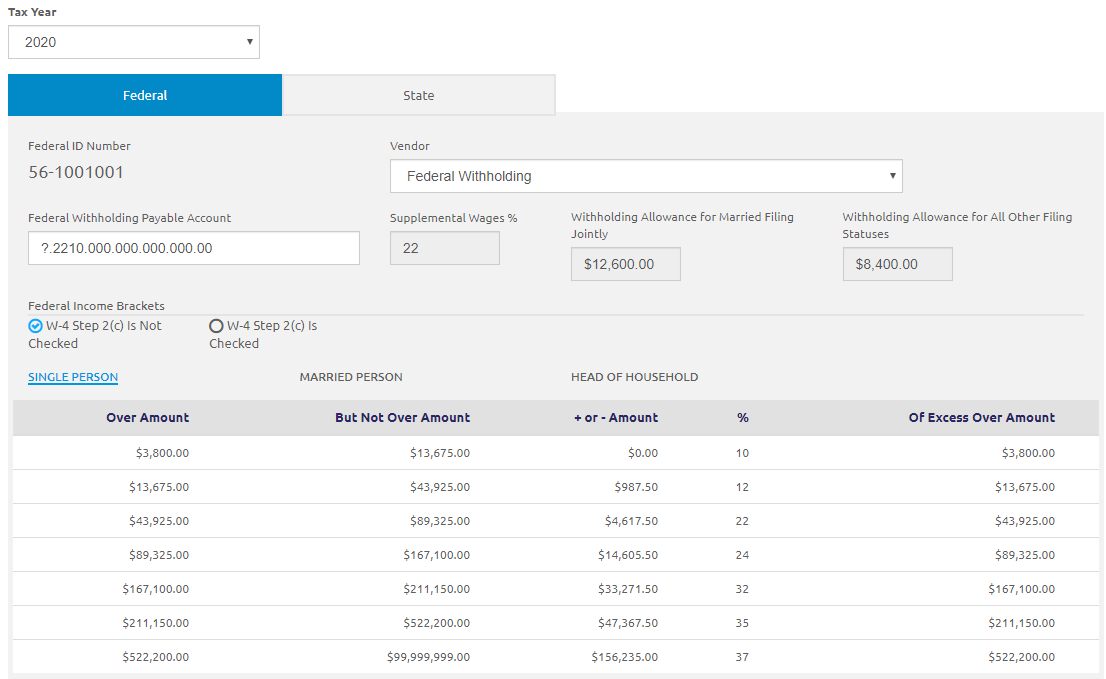

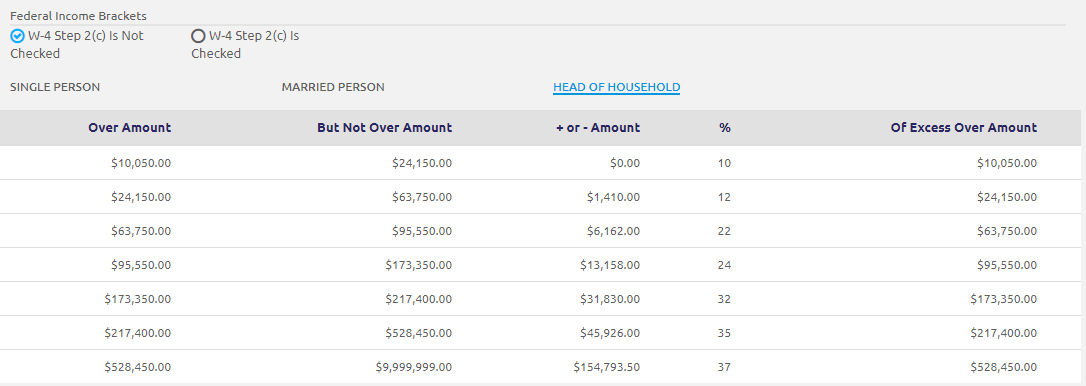

Federal Income Brackets

Income Brackets are automatically populated by School LINQ and are for reference only.

- For tax years 2020 and later, select either W-4 Step 2(c) Is Not Checked or W-4 Step 2(c) Is Checked.

- If W-4 Step 2(c) Is Not Checked is selected, the Withholding Allowance for Married Filing Jointly field and the Withholding Allowance for All Other Filing Statuses field will display as read-only.

- If W-4 Step 2(c) Is Checked is selected, the Withholding Allowance field will display as read-only.

-

Click SINGLE PERSON, MARRIED PERSON, and HEAD OF HOUSEHOLD to view the Over Amount, But Not Over Amount, + or - Amount, %, and Of Excess Over Amount amounts.

- Click the

button.

button.

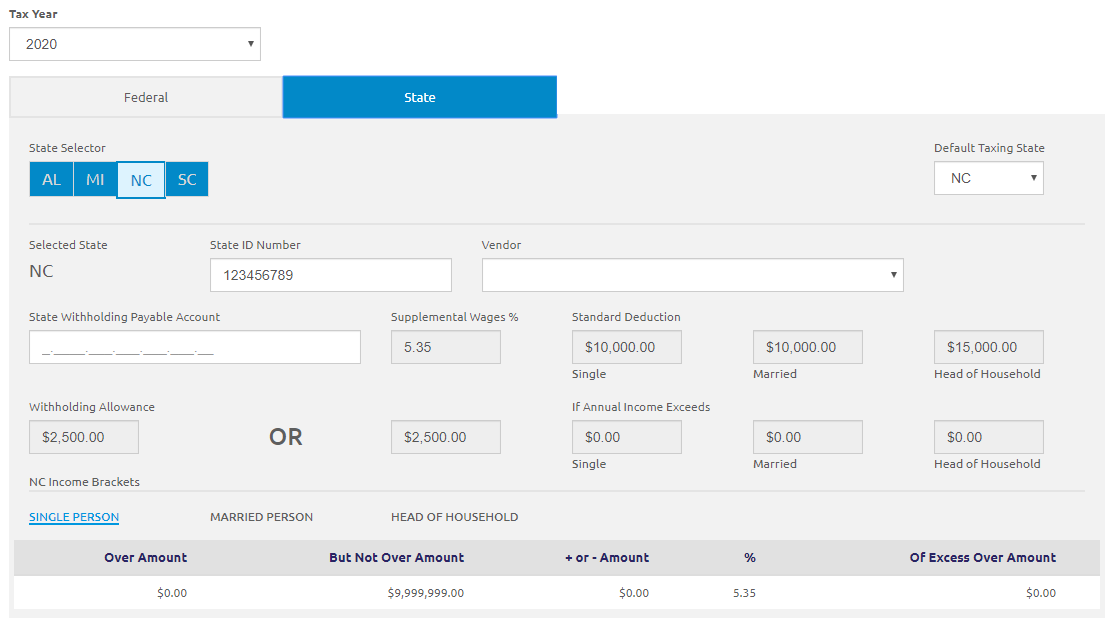

State Tab

- Select a year from the Tax Year drop-down list.

- The district's Default Taxing State will be the state that all employees are automatically set to, and taxed, based on that states tax table when Calculating Payroll. This can be edited.

- Employee Taxing State can be changed at the employee level.

- States available for selection on the employee level will be limited to only states that the Unit has taxing tables set up for.

- Select a state from the State Selector section. The state’s tax tables will display.

- Enter the State ID Number in the State ID Number field.

- Select the vendor to be paid from the Vendor drop-down list. When payroll is finalized, invoices will be generated to this vendor for all state taxes withheld. Vendors are managed in Fund Management.

- Enter the account code template to be used for federal withholding in the State Withholding Payable Account field. Payroll processing will use the job’s account digits in place of the question marks on the template.

- NOTE: The State ID Number, Vendor, and State Withholding Payable Account fields must be set per state that will be used withinPayroll.

- The Supplemental Wages % and Withholding Allowance fields are automatically populated by School LINQ each year according to your individual State's published tax tables.

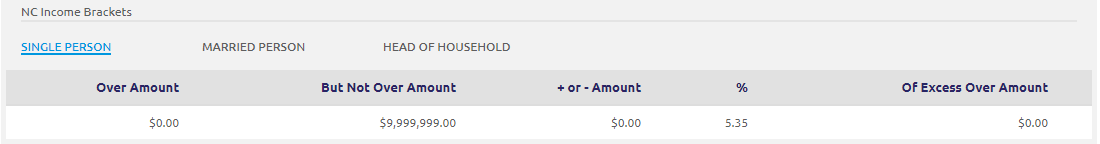

State Income Brackets

Income Brackets are automatically populated by School LINQ and are for reference only.

- Click SINGLE PERSON, MARRIED PERSON, and HEAD OF HOUSEHOLD to view the Over Amount, But Not Over Amount, + or - Amount, %, and Of Excess Over Amount amounts.

-

Click the

button.

button.

©2021 | EMS LINQ, Inc.

School LINQ Help, updated 01/2021